Sustainable and responsible investing

A good pension in a livable world

We as a pension fund also assume our social responsibility. The Board of PDN considers sustainability to be a major aspect of the investment philosophy and a full component of PDN's investment principles. PDN is the company fund of DSM Nederland and its affiliated companies. We believe it is important to have a sustainability policy that is in line with DSM’s standards and values.You can read a brief outline of how we are addressing this and what we achieved in 2022 here.

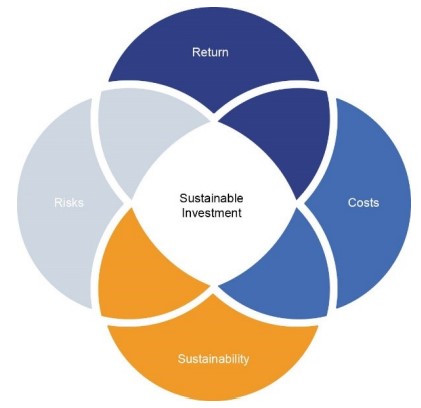

We see it as our main task to continue to provide a good pension, now and later, which is why we invest our members' pension contributions in a responsible way. Numerous scientific studies have strengthened our belief that sustainability does not need to be at the expense of return on investments. On the contrary, we can take better-informed investment decisions by incorporating information about people, the environment, and good corporate governance in our policy. Certainly because we are investing for the long term.

Would you like to receive detailed information about our Sustainability Policy? Then click here.

But how do you do that? Socially responsible or sustainable investing?

To start, a general short video (click on image) on 'Duurzaam beleggen: het nieuwe normaal' (Sustainable Investing: the new normal).

To start, a general short video (click on image) on 'Duurzaam beleggen: het nieuwe normaal' (Sustainable Investing: the new normal).

What does PDN want to achieve with sustainable investing?

In addition, at the end of 2018, PDN and other pension funds signed the Covenant on International Socially Responsible Investment by Pension Funds. The signatories of this Covenant have opted for an approach that takes the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights as the basis for identifying, prioritizing, and addressing Environmental, Social, and Governance (ESG) risks.

In committing to these guidelines and principles, we aim to focus on specific societal developments that are important for our members and have been identified as high risk for the investment portfolio.

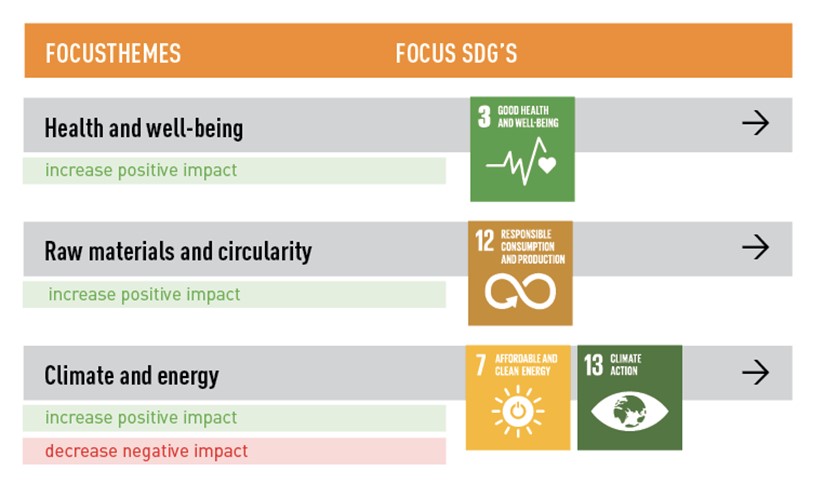

Our sustainability policy currently focuses specifically on three themes: health and welfare, climate and energy, and raw materials and circularity.  These themes are linked to four of the UN's Sustainable Development Goals (SDGs). In particular, we focus on:

These themes are linked to four of the UN's Sustainable Development Goals (SDGs). In particular, we focus on:

SDG 3 – good health and welfare;

SDG 7 – affordable and sustainable energy;

SDG 12 – responsible consumption and production; and

SDG 13 – climate action.

Overview of Focus Themes and SDGs

Policy instruments as a basis

PDN's sustainability policy is built around the following six policy instruments:

ESG stands for Environment, Social, and Governance. PDN firmly believes that taking ESG criteria into account when making investment decisions leads to better results and better risk management in the long term. Therefore, one of the things we use in our investment portfolio is concrete targets for reducing CO2 emissions.

To align ourselves with the Paris Climate Agreement, we set a long-term reduction target in 2021: net zero CO2 emissions from our investment portfolio by 2050. We also set a target for the near future: PDN aims for a reduction in carbon emissions of 55% by 2030 compared with the 2016 benchmark for shares, investment grade credits and high-yield US.

Outcome of the objectives for CO2 reduction

Outcome of the objectives for CO2 reduction

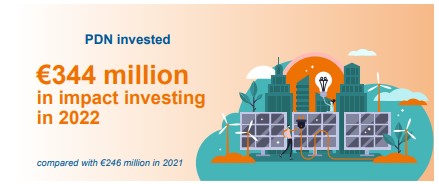

Through our impact investing, in addition to achieving financial returns, we also want to contribute to solving various social and sustainability challenges. In doing so, we are in line with the vision of the United Nations, which states that, in order to achieve a livable, sustainable world by 2030, all 17 SDGs must be achieved. Therefore, we define an investment as an impact investment if it makes a positive contribution to at least one of the 17 SDGs.

Through our impact investing, in addition to achieving financial returns, we also want to contribute to solving various social and sustainability challenges. In doing so, we are in line with the vision of the United Nations, which states that, in order to achieve a livable, sustainable world by 2030, all 17 SDGs must be achieved. Therefore, we define an investment as an impact investment if it makes a positive contribution to at least one of the 17 SDGs.

An example of a sustainable investment in the European share portfolio is the investment in Siemens Energy AG. This company offers energy-based products and solutions and, with Siemens Gamesa, is active globally in the sustainable wind industry.

Outcome of the objectives for Impact Investments

Positive contributions to SDGs can be made within government and corporate bonds by investing in impact bonds: Green bonds, social bonds, and sustainability-linked bonds. We started measuring the percentage of impact bonds in our investment portfolio in late 2021.

PDN wants investments to have as much positive impact as possible and as little negative impact on the world as possible. We believe a combination of engagement and voting is the most effective method to get companies to change their behavior. We entrust our engagement activities to Columbia Threadneedle Investments (CTI), who acts as an engagement party on behalf of a number of institutional investors.

We expanded our engagement policy in 2021 to ensure a more precise focus on the companies that have a bearing on our focus themes. In 2022, we set a target for at least 25% of the total number of engagements to be focused on SDGs 3, 7, 12, and 13.

In the end, we achieved a percentage of 36% – above target. Besides this, we stipulated that we will exclude companies if, over a period of three years, they do not make progress in an engagement process in connection with our focus themes.

Some examples of our engagement progress:

Climate Action 100+

PDN is affiliated with Climate Action 100+, an initiative to ensure that the world’s largest emitters of greenhouse gases are taking the necessary action to address climate change. More than 700 investors worldwide, with over $65 trillion in managed assets, engage with companies to improve their climate change policies, reduce emissions, and improve climate-related reporting.

Acces to medicine

On behalf of PDN, CTI met with various companies, including GSK, AstraZeneca, and Novartis to discuss access to medicines. They discussed the companies’ scores on the Access to Medicine Index: an initiative that provides insight into drug manufacturer policies in providing necessary medicines to the world’s poorest. They also discussed how they are using the index findings. Three developments were clear. First, access strategies have increased in the sector and the gap between the companies has reduced. Second, the index is widely recognized and ‘keeps companies on their toes’, especially regarding access strategies for the world’s poorest. Finally, the industry is struggling to measure the impact of their access strategies and often uses a variety of metrics to determine this.

Responsible Production

CTI is also in dialogue with companies on behalf of PDN with respect to our focus theme ‘Raw materials and circularity’. An example of this is Mettler-Toledo, a multi-national manufacturer of scales and analytic instruments. It is the largest supplier of scales for use in laboratory, industrial, and food retailing. In 2022, Mettler-Toledo formulated new targets for sustainable packaging materials, including >80% from recycled or certified sustainable sources, and >95% easily recyclable or compostable by 2025.

Coal Phase-Out van kolen

German company RWE is active in the generation, transmission, and distribution of electricity and gas. The company is one of the last European utilities that still has interests in coal mines and plants. RWE was affected by Russia’s invasion of Ukraine and the impact of this on energy and gas prices in the EU, which in turn impacted the carbon reduction strategy. The German government contracted RWE to reopen 1.3 GW in closed coal plants until March 2024.

In 2022, CTI discussed the consequences of the European energy situation on net zero and on the biodiversity and climate risk approach several times with RWE’s IR team and head of sustainability. There are shared expectations regarding coal phase-outs, namely that RWE formulates clear plans for the post-2024 phase-out of the reopened power plants and that once the German government has brought forward the coal phase-out, work will resume with a science-based target of 1.5°C. RWE’s plans to convert several plants to biomass were also discussed. Concerns were expressed particularly about the purchase of biomass from Eastern European countries that have poor forest management. RWE assured us that the short-term investment targets for sustainable energy will increase, although the regional focus may shift from the US and UK to Germany because of the changing political landscape.

Biodiversity

The scale of current biodiversity loss poses a major threat to our ecosystems. CTI launched an engagement project for this purpose, including on behalf of PDN, two years ago. This project has led to dialogue with 21 companies in the transport, finance, non-sustainable consumer products, and raw material extraction sectors to stop activities that are harmful to global biodiversity.

Outcome of the objectives for Engagement

In addition to engagement, PDN sees voting as the most effective way to influence companies to change their behavior and thereby contribute to curbing negative impacts, and increasing positive impacts. We therefore believe that exercising our right to vote is particularly important.

From 2022, we will vote both for our Dutch investments and for all global, listed investments. This expansion resulted in more than 13,000 proposals being voted on in 1,095 shareholder meetings last year. On over 20% of those proposals, CTI voted against, cast blank votes, or abstained on behalf of PDN. As this was not possible at 7 meetings due to applicable liquidity constraints, we did not achieve our ambition but are nevertheless satisfied with the final result.

Every quarter, we publish on our website the votes made on behalf of PDN in general meetings of the companies in which we invest. These are published per individual company and per voting point.

Outcome of the objectives for the Voting Policy

In 2022, PDN excluded 168 companies and 14 countries from its investment portfolio – 37 companies and one country more than in 2021. A prominent example is Gazprom, the largest natural gas company in the world, which is largely owned by the Russian state.

Outcome of the objectives for Exclusion

Reporting

PDN publishes an annual sustainability report to ensure transparency about the sustainability policy and its implementation. In this report, we indicate how we handled sustainability in that year and which results were achieved with respect to sustainability.

In the context of transparency about where PDN invests, we publish an annual overview of the total investment portfolio on our website. For more information visit our website Investment policy at PDN. We also report the results of Vote Summary Report at shareholders’ meetings on our website. The PDN Magazine and the website also regularly feature items on PDN’s sustainability policy.

Sustainability Activities in 2023

The fund’s sustainability policy will again be prominent on the agenda of PDN’s Board in 2023. Some of the sustainability activities we defined for 2023 are:- Investigating the expansion of the exclusion policy based on a tightened country policy;

- Examining how we can integrate climate risk into the investment process;

- Providing clarity on the positive and negative impact of the share and corporate bond portfolios in relation to the focus SDGs (3, 7, 12, and 13);

- Evaluating the policy relating to impact investing and where necessary introduce refinements.

- Boosting support for sustainable and responsible investment among our members by reporting more about sustainability activities and results.